UiPath Stock: Buy The Bottom (NYSE:PATH)

Written by Lucky Wilson | KGTO Writer on May 15, 2022

Sergey_P/iStock via Getty Images

Note: Timing the Market subscribers gained early access to this article.

UiPath (NYSE:PATH) is reporting its earnings on the first of June, and I believe this is an excellent buy-in point:

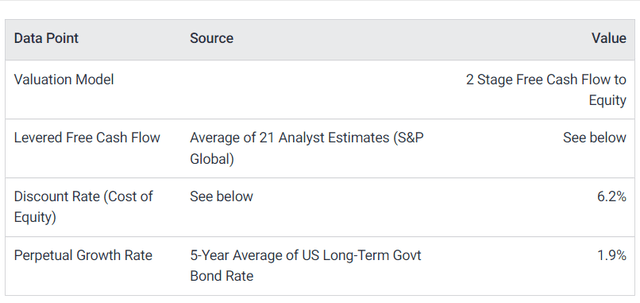

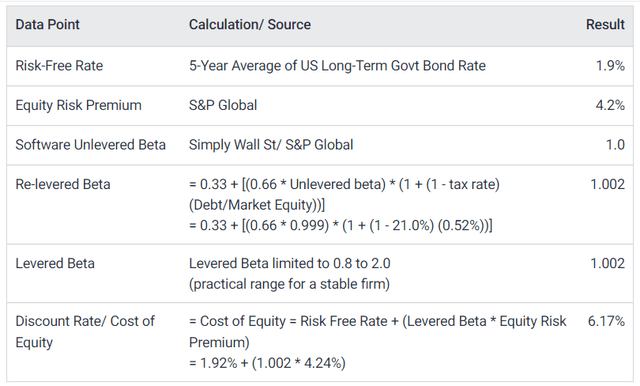

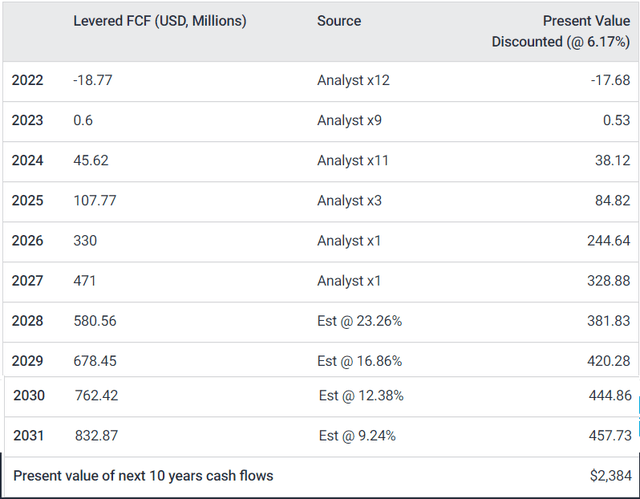

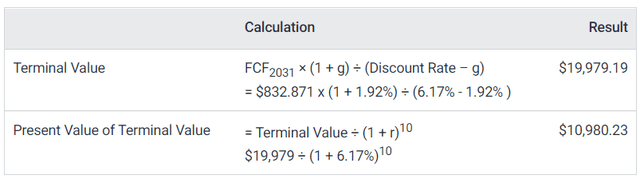

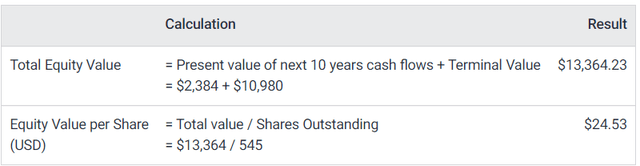

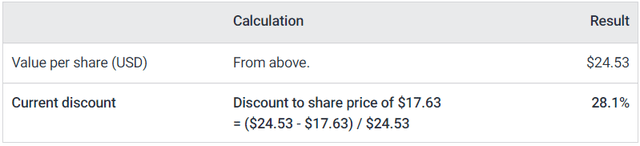

Let’s start with the company’s financials. The company is extremely healthy from a financial standpoint and the current price seems unjustified from this perspective. A basic discounted cash flow analysis puts PATH at around 30% underpriced:

Damon Verial Damon Verial Damon Verial Damon Verial Damon Verial Damon Verial

Clearly, UiPath’s stock is being discounted for some reason. A deeper look into the company shows overall health but several macro headwinds, which is the most likely reason for this discounting. Headwinds include post-Covid expenses (e.g., getting teams back to offices), FX issues (e.g., the USD/JPY is at a relative high, and Japan is a significant revenue source for UiPath), and the cloud transition will lead to a revenue hit (estimated to be 4%).

However, with so many headwinds priced into this stock, I find it difficult to imagine the upcoming earnings call will present a more dire macro situation than that we are already assuming. That is, the market has already priced in what is essentially the worst-case situation. I believe that this quarter’s earnings call will give much more optimistic guidance, fueling more buying pressure.

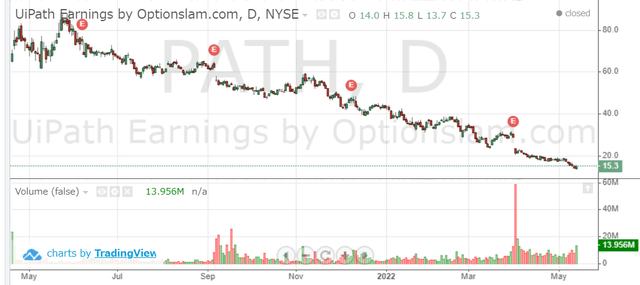

In addition, this quarter’s earnings is somewhat special. This is important to note because the earnings pattern thus far in PATH is highly bearish. Every earnings to-date has been disastrous for PATH investors:

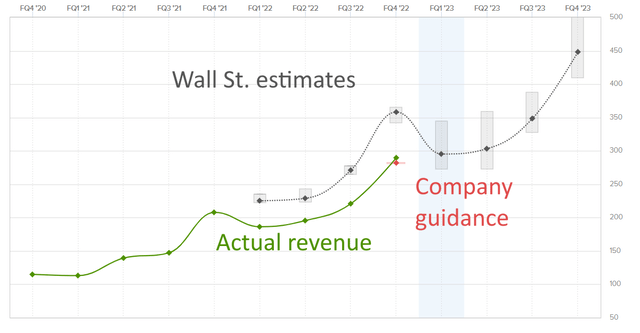

But you should notice that this quarter is the first in which PATH will be going into earnings at an undervaluation versus its discounted cash flow valuation. Moreover, it is the first quarter in which analysts have reduced their expectations with regard to revenue, the main metric of interest (SaaS companies care more about revenue than EPS due to using ARR as the primary metric of success). Note that the analysts have always been overly optimistic, even when company guidance is relatively accurate:

From a seasonal perspective, Q1 tends to see a large increase in revenue. And from a perspective of momentum, we have no reason to believe revenue will stop increasing, yet a significant portion of analysts predict a drop in revenue. Or, another way to see it is that analysts are making much more reasonable estimates seeing as they’ve been burned the last four quarters.

To me, this says that UiPath will have a much easier time than the average stock in surpassing its expected financial numbers in the upcoming report, pointing to significant potential upside. Likewise, the potential downside is low, giving that the stock has already sold off so much this year and given that analysts are no longer setting unreasonably high expectations for the company. I believe the hype money has already left this stock and that moving forward we should see the stock price move much more in alignment with the actual fundamentals, which are both good and improving.

In short, I believe that the macro issues have already been discounted – overly discounted, in fact. The potential upside here is high, and the upcoming Q1 earnings report represents a potential inflection point for the company. I want to take a speculative position based off this thesis.

For this play, I like long-dated out-of-the-money calls. They are cheap but can easily give triple-digit ROI if PATH performs well on earnings. With calls, your maximum risk is the debit paid for the option, which – in this case – is a mere $15 each:

Buy Aug19 $35 calls

Let me know what you think.

Source link