Brokerages expect Synovus Financial Corp. (NYSE:SNV – Get Rating) to post sales of $514.59 million for the current fiscal quarter, Zacks reports. Six analysts have made estimates for Synovus Financial’s earnings, with the highest sales estimate coming in at $526.60 million and the lowest estimate coming in at $503.10 million. Synovus Financial reported sales of $488.95 million during the same quarter last year, which would suggest a positive year-over-year growth rate of 5.2%. The firm is expected to report its next earnings report on Monday, January 1st.

On average, analysts expect that Synovus Financial will report full year sales of $2.09 billion for the current financial year, with estimates ranging from $2.05 billion to $2.13 billion. For the next financial year, analysts forecast that the company will post sales of $2.30 billion, with estimates ranging from $2.18 billion to $2.42 billion. Zacks’ sales calculations are an average based on a survey of research analysts that cover Synovus Financial.

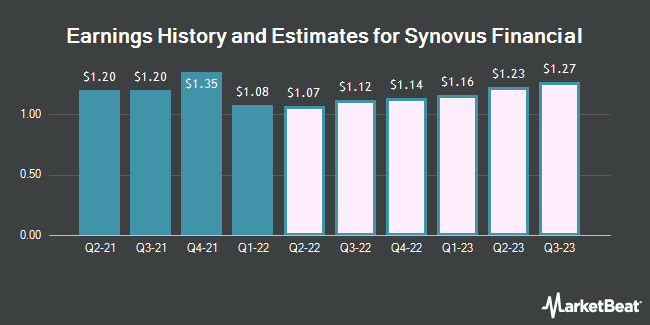

Synovus Financial (NYSE:SNV – Get Rating) last announced its quarterly earnings data on Thursday, April 21st. The bank reported $1.08 earnings per share (EPS) for the quarter, beating the Zacks’ consensus estimate of $1.01 by $0.07. The firm had revenue of $498.50 million during the quarter, compared to analyst estimates of $497.35 million. Synovus Financial had a net margin of 36.15% and a return on equity of 16.18%. Synovus Financial’s quarterly revenue was up 2.7% on a year-over-year basis. During the same quarter in the prior year, the firm posted $1.21 earnings per share.

Several brokerages have weighed in on SNV. StockNews.com began coverage on shares of Synovus Financial in a research note on Thursday, March 31st. They set a “hold” rating for the company. Raymond James lowered their target price on shares of Synovus Financial from $58.00 to $57.00 and set an “outperform” rating for the company in a research note on Friday. Zacks Investment Research raised shares of Synovus Financial from a “hold” rating to a “strong-buy” rating and set a $53.00 target price for the company in a research note on Tuesday, April 12th. Wells Fargo & Company lowered their price objective on shares of Synovus Financial from $70.00 to $65.00 and set an “overweight” rating for the company in a research note on Friday. Finally, Piper Sandler lowered their price objective on shares of Synovus Financial from $61.00 to $60.00 and set an “overweight” rating for the company in a research note on Friday. One equities research analyst has rated the stock with a hold rating, seven have issued a buy rating and one has assigned a strong buy rating to the company’s stock. Based on data from MarketBeat.com, the company has a consensus rating of “Buy” and a consensus target price of $58.88.

In other news, CEO Kevin S. Blair bought 3,100 shares of Synovus Financial stock in a transaction that occurred on Thursday, February 24th. The shares were purchased at an average price of $48.49 per share, with a total value of $150,319.00. The acquisition was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. 1.55% of the stock is owned by company insiders.

A number of large investors have recently modified their holdings of SNV. Sageworth Trust Co of South Dakota acquired a new stake in Synovus Financial during the fourth quarter worth approximately $25,000. Covestor Ltd acquired a new stake in Synovus Financial during the fourth quarter worth approximately $29,000. Smith Group Asset Management LLC acquired a new stake in Synovus Financial during the fourth quarter worth approximately $39,000. Ellevest Inc. raised its holdings in Synovus Financial by 15.6% during the fourth quarter. Ellevest Inc. now owns 1,856 shares of the bank’s stock worth $89,000 after purchasing an additional 250 shares in the last quarter. Finally, Toronto Dominion Bank raised its holdings in Synovus Financial by 29.6% during the third quarter. Toronto Dominion Bank now owns 2,635 shares of the bank’s stock worth $116,000 after purchasing an additional 602 shares in the last quarter. 77.76% of the stock is currently owned by hedge funds and other institutional investors.

Shares of SNV stock opened at $44.36 on Friday. The company has a debt-to-equity ratio of 0.25, a current ratio of 0.86 and a quick ratio of 0.84. The firm has a market cap of $6.45 billion, a PE ratio of 9.09, a price-to-earnings-growth ratio of 6.34 and a beta of 1.41. The company has a 50-day moving average of $48.98 and a two-hundred day moving average of $48.75. Synovus Financial has a 1-year low of $38.42 and a 1-year high of $54.40.

The company also recently announced a quarterly dividend, which was paid on Friday, April 1st. Investors of record on Thursday, March 17th were issued a $0.34 dividend. This is a boost from Synovus Financial’s previous quarterly dividend of $0.33. The ex-dividend date of this dividend was Wednesday, March 16th. This represents a $1.36 annualized dividend and a yield of 3.07%. Synovus Financial’s dividend payout ratio (DPR) is 27.76%.

About Synovus Financial (Get Rating)

Synovus Financial Corp. operates as the bank holding company for Synovus Bank that provides commercial and retail banking products and services. It operates through three segments: Community Banking, Wholesale Banking, and Financial Management Services. The company’s commercial banking services include treasury management, asset management, capital market, and institutional trust services, as well as commercial, financial, and real estate loans.

Featured Articles

Get a free copy of the Zacks research report on Synovus Financial (SNV)

For more information about research offerings from Zacks Investment Research, visit Zacks.com

Receive News & Ratings for Synovus Financial Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Synovus Financial and related companies with MarketBeat.com’s FREE daily email newsletter.