Meta (NASDAQ:FB): Headwind Solidified Its FAANG Stock Status

Written by Lucky Wilson | KGTO Writer on June 18, 2022

photoschmidt/iStock via Getty Images

Investment Thesis

FB 10Y P/E Valuations

S&P Capital IQ

Meta Platforms, Inc. (FB)’s P/E valuations have been drastically moderated to their lowest range since its IPO, from 70.15x on 18 May 2012 to 16.44x on 27 May 2022. Nonetheless, long-term investors need not be worried, given that the stock has also appreciated by 603.93% in the past ten years.

FB 10Y Stock Price

Seeking Alpha

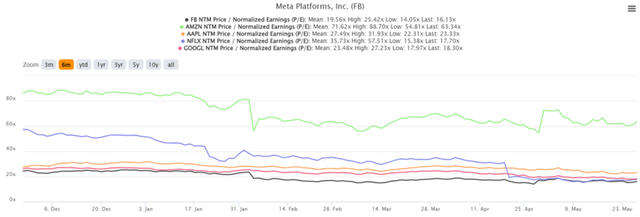

6M P/E Valuations For FAANG Stocks

S&P Capital IQ

From the chart, we can see that FB (in black) provides the best bang for the buck among the FAANG stocks, given its reasonable P/E valuations of 16.44x, compared to Amazon (AMZN) at 63.43x, Apple (AAPL) at 23.33x, Netflix (NFLX) at 17.7x, and Alphabet (GOOG) at 18.3x. With its stellar operating metrics and highly moderated P/E valuations, the stock remains an excellent buy at an attractive entry point for tech investors in the current bear market. In addition, FB demonstrated its massive relevance in the highly competitive social media industry through its decent FQ1’22 earnings, despite the temporary headwinds from the privacy changes from AAPL.

We shall discuss this further.

FB Performed Well In FQ1’22 Despite Multiple Headwinds

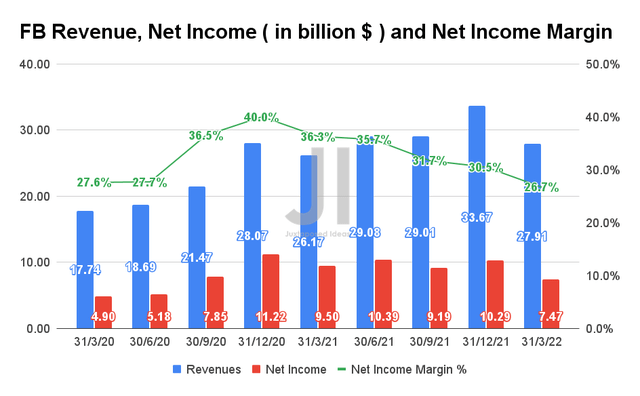

FB Revenue, Net Income, and Net Income Margin

S&P Capital IQ

For FQ1’22, FB reported revenues of $27.91B and a net income of $7.47B, representing an increase of 6.6% YoY and a decline of -21.3% YoY. Given the headwinds from AAPL, increased operating expenses, deceleration in e-commerce growth post reopening cadence, and global macro issues, it is also evident that the company’s net income profitability margin has declined YoY, from 36.3% in FQ1’21 to 26.7% in FQ1’22.

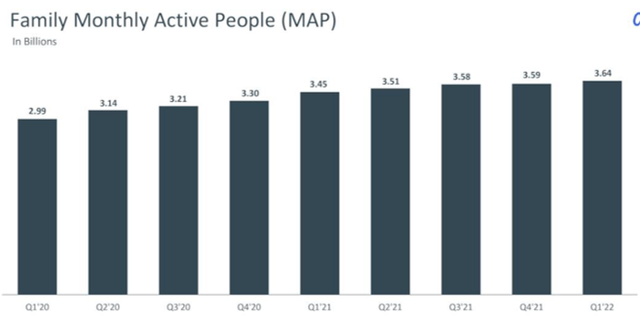

FB Family MAP

Seeking Alpha

Nonetheless, we expect the headwinds to be temporary, given FB’s continued growth in the Family Monthly Active People (MAP) in FQ1’22, which grew by 1.3% QoQ and 5.5% YoY to 3.64B users. It is impressive, given that it represents 46% of the world’s 7.9B population as of 2022. In addition, FB’s Family average revenue per person was also in line YoY at $7.72, therefore preserving a certain level of sales and profitability. Furthermore, its Facebook Monthly Active Users (MAU) still grew by 1.6% QoQ and 2.9% YoY to 2.93B, despite previous reports of younger audiences leaving for trendier platforms. As a result, we can surmise that FB remains a highly successful social media company, given that three of its platforms, including Facebook, WhatsApp, and Instagram, remain in the top five most popular social networks globally in 2022.

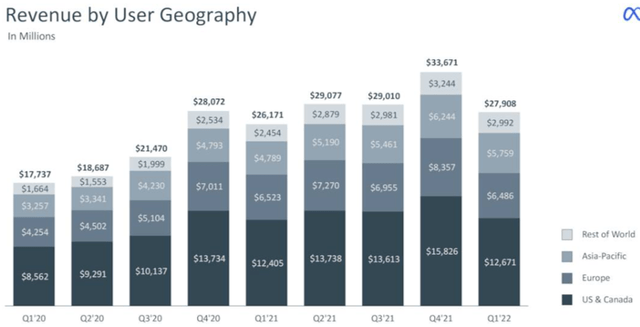

FB Revenues By Geography

Seeking Alpha

Furthermore, we can see that FB’s execution remains exemplary in FQ1’22, despite multiple headwinds. Though the company mainly reported in line revenues from the UCAN and the EU regions, it reported 20.2% YoY growth in the APAC region and 21.9% in the ROW. Given the ongoing Ukraine war impacting advertiser/ consumer spending in the EU and the rising interest rates and inflation impacting those in the US, we can surmise that the headwinds will potentially be alleviated from 2023 onwards. Though the Digital Markets Act could also be an issue in the EU, we expect FB to rise above the challenges and prevail after short-term adjustments, given that it is an industry-wide problem.

FB Is Still Rolling In Cash Despite Major Investments

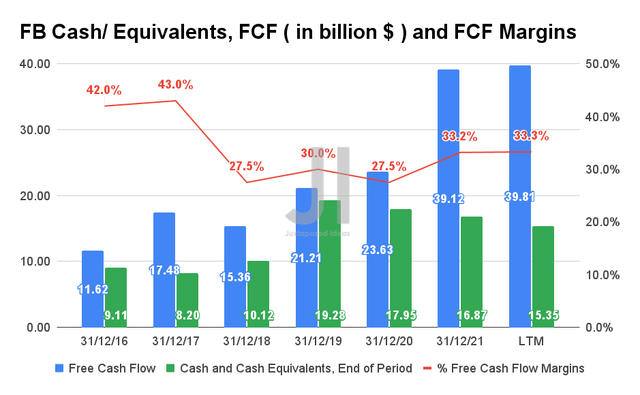

FB Cash/ Equivalents, FCF, and FCF Margins

S&P Capital IQ

It is evident that FB is also highly profitable, generating excellent Free Cash Flows (FCF) and improving FCF margins. In the LTM alone, the company reported an FCF of $39.81B with FCF margins of 33.3%, mainly attributed to the hypergrowth of the e-commerce industry during the COVID-19 pandemic. Combined with its war chest of $15.35 of cash and equivalents, we are not concerned about its expanding operating expenses, given its fundamentally profitable core business.

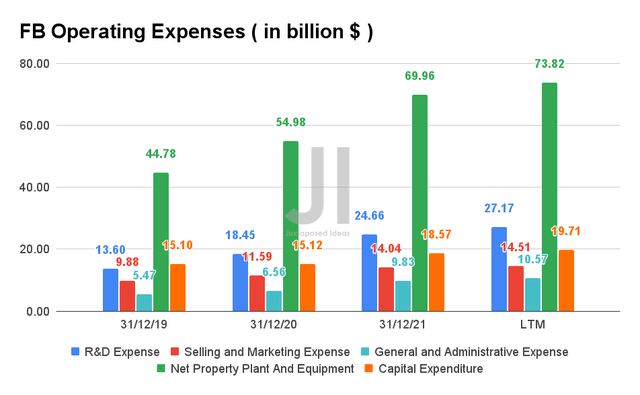

FB Operating Expenses

S&P Capital IQ

In the last twelve months (LTM) alone, FB spent $52.25B in R&D, Selling/ Marketing, and General/ Administrative Expenses, while also aggressively expanding its capital expenditure to $19.71B with a total net property plant and equipment assets worth $73.82B by FQ1’22. Much of these were attributed to the company’s long-term investments in its Family of Apps, Reality Labs, and Data Center capabilities.

Notably, Facebook is increasing its AI investments to better deal with AAPL’s $10B headwinds, which had previously caused its stock to crash after the FQ4’21 earnings call. As a result, we are encouraged that FB has been putting its massive FCF to good use, since these investments will directly contribute to its future success and, consequently, the top and the bottom line moving forward. RBC Capital Markets analyst Brad Erickson, said:

FB’s unmatched scale and targeting vs. social peers remains a competitive advantage and keeps us at Outperform but will need to show meaningful improvement to the various headwinds upcoming if the stock is going to more sustainably work. (Seeking Alpha)

Nonetheless, given multiple temporary headwinds, it also makes sense for FB to reduce its operating expenses by $3B for FY2022 to prioritize its overall profitability. In addition, the company aims to fund its massive investments in the Reality Labs directly through the operating income from its Family of Apps segment by 2023, therefore moderating the short-term concerns. Consequently, it is not a surprise that the stock had rallied by 27.6% post FQ1’22 earnings, from $174.95 on 27 April 2022 to $223.41 on 4 May 2022, though it is also apparent that some of those gains have been digested by now.

FB’s Growth Is Only Normalized, Not Cannibalized

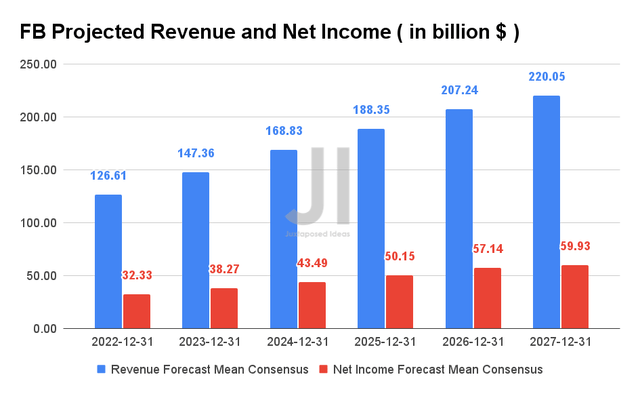

FB Projected Revenue and Net Income

S&P Capital IQ

FB is expected to grow its revenues and net income at an excellent CAGR of 11.69% and 13.34%, respectively. In addition, consensus estimates that the company will report revenues of $126.61B and net income of $32.33B for FY2022, representing a YoY growth of 7.3% and a decline of -17.7%, respectively. FB also guided FQ2’22 revenues in the range of $28B to $30B, representing an increase of 7.4% QoQ and 3.1% YoY. Despite the deceptive appearance of softer guidance, $30B still represented an impressive revenue CAGR of 26.69% since FQ2’20. As a result, we could also potentially attribute it to the normalization of FB’s e-commerce and advertising growth due to the global reopening cadence.

In the meantime, we encourage you to read our previous article on FB, which would help you better understand its position and market opportunities.

- Meta Vs. Roblox (RBLX): The Battle Of Metaverse Commission Rates – 47.5% Vs. 72%

- Meta Platforms Vs. ByteDance (BDNCE): The Impact Of TikTok On Instagram

So, Is FB Stock A Buy, Sell, Or Hold?

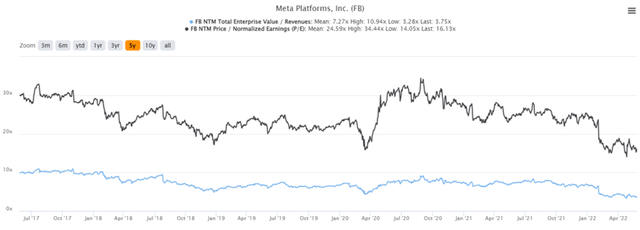

FB 5Y EV/Revenue and P/E Valuations

S&P Capital IQ

FB is currently trading at an EV/NTM Revenue of 3.75x and NTM P/E of 16.13x, lower than its 5Y mean of 7.27x and 24.59x, respectively. In addition, the stock is also trading at $191.63 on 26 May 2022, down 50.1% from its 52 weeks high of $384.33, though at a premium of 13.3% from its 52 weeks low of $169. As a result, we reckon that FB is trading at ridiculously cheap valuations, given its mature business model in comparison with other FAANG stocks, as discussed above.

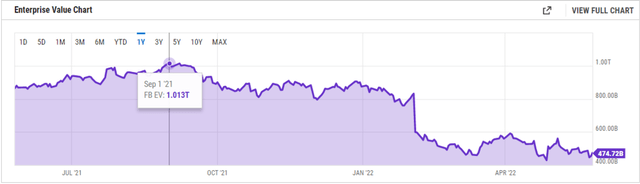

FB Enterprise Value

Ycharts

However, given the drastic correction in February 2022, it is also apparent that FB has lost 53.1% of its Enterprise Value, or the equivalent of $538.28B from its 1Y peak, from $1.013T in September 2021. As a result, anyone who had bought during the pandemic would have lost all of their gains by now. Nonetheless, we reckon this is an excellent opportunity for those who have yet to add this high-growth stock with excellent operating metrics and massive future potential.

Therefore, we reiterate our Buy rating for FB stock.

Source link