IAC/InterActiveCorp Stock: Best Internet Content Investment

Written by Lucky Wilson | KGTO Writer on February 14, 2022

Pgiam/iStock via Getty Images

Investment Thesis

We have a special way of looking at stocks and ETFs.

This article will use IAC/InterActiveCorp (IAC) as an illustration of our ongoing search for the most likely identification of near-term capital gain prospects.

If you have seen this explanation before, please jump to the next bold-faced headline.

Technology advances in communications and information have transformed the lives of nearly every resident of “developed countries” of the world, with the internet being the principal conduit. Many left-behind locales are now being positively impacted, adding to the reach of progress because of technology’s reduction of cost of delivery and pervasive presence. There are huge benefits to be had for mankind in coming months and years ahead, assuring ongoing demand for variations of the Internet’s services, making it an essential aspect of all investors’ portfolios.

Securities markets have evolved in parallel, to the point of automating the transactions between individual investors such that former “commission” costs have been eliminated for the bulk of trades done via the internet.

But the equities markets really serve two customer groups: Individuals making smaller-value trades, and “Institutions” managing fund portfolios of multi-Billion-$ holdings. Their more irregular, huge trade orders usually require special “Market-Maker” actions to balance share availabilities with demands.

Advances in information technology encourage investment professionals (the market-making [MM] community) to protect the capital they must put at risk to do their jobs. Those actions cause the markets for equities and derivatives to become more integrated than they were in much of the 20th century.

So we study what the Pros’ behavior causes to happen in the price-change “insurance” derivatives markets, to understand just how far it is reasonable to believe specific stock and ETF prices may move, both up and down, in the next few months.

This analysis has been conducted without material change daily for over a decade on more than 3500 widely-held and actively-traded stocks and ETFs. The resulting price range forecasts provide an actuarial history (unmatched elsewhere in the investment community) of subsequent market prices, as testimony to the strength or weakness of the forecasts made earlier.

Near-term price gains are most important to investors who are now either starting out in building a portfolio’s wealth and exploring how it may best be done, or to investors who have come to realize that retirement plans made years earlier are unlikely to be met at current rates of investment wealth accumulation.

Active Investing in Internet Content Stocks

Active investing, where capital is constantly put to work in the best odds-on situations to deliver profit within foreseeable time horizons, is the strategy most likely to produce what is needed, at least risk. But active investing needs guidance as to what to do, when to do it, and with what intensity.

Company Description, Growth outlook

“IAC/InterActive Corp operates as a media and internet company worldwide. The company offers digital marketplace service which connects consumers with service professionals for repairing, remodeling, cleaning, and landscaping solutions under the Home Advisor, Angie’s List, and Handy brands; Vimeo, a cloud-based software platform for professionals, teams, and organizations to create, collaborate, and communicate with video; and Dotdash, a portfolio of digital publishing brands that provides information and inspiration in select vertical content categories. The company was formerly known as IAC Holdings Inc. IAC/InterActive Corp is headquartered in New York, New York.”

Source: Yahoo Finance

Yahoo Finance

Internet Content & Services stocks at this time are good vehicles for Active Investing as a strategy for several reasons. The Covid-19 commercial business disruption has refocused consumer spending on personal items and provided cash availability to many not often long with cash to spend.

Interim setbacks and failures keep opportunity valuations in flux among many enterprises. Physical development times and marketing efforts under government regulations and peer review progress vary across international boundaries. Competitive pressures from new organizations’ blossoming successes can impact established firms.

The investing result is that far more price-change activity for near-term capital gains and losses exists than is to be earned from 20th century “long-term-trend growth and income” strategies. What is needed to capture the opportunities and minimize losses is a demonstrated perspective, stock by stock, of what range of market prices are being expected now and in the near future. The kind we find from retail volume-trade transaction behavior, as seen through institutional investor trade orders.

Thus we have specific, honest unbiased forecasts of future price limits, both up and down, motivated by the self-serving competing interests of the participants in an open-market negotiation.

Those limits can help define prospective investment reward and risk on an issue-by-issue basis that is directly comparable between alternatives, regardless of their underlying competitive or economic circumstances. Those essential minutiae have been subsumed in the hedging negotiations.

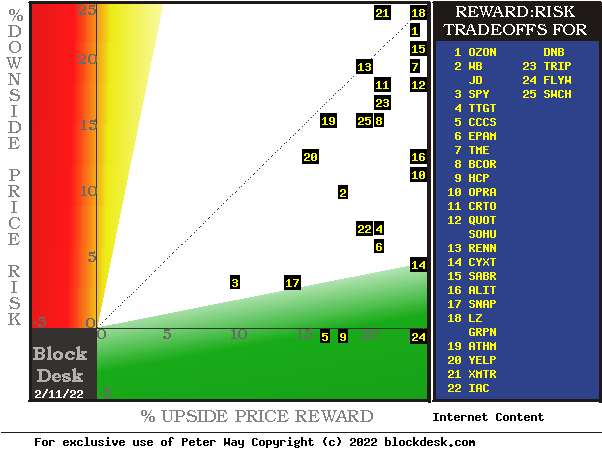

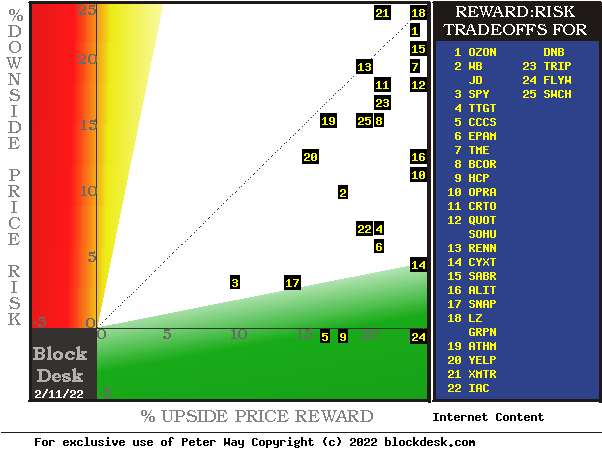

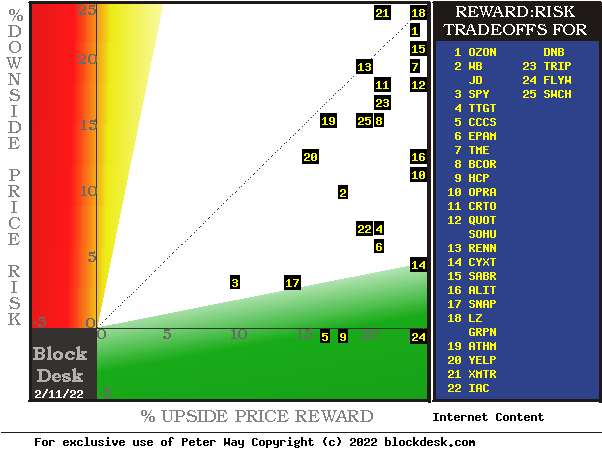

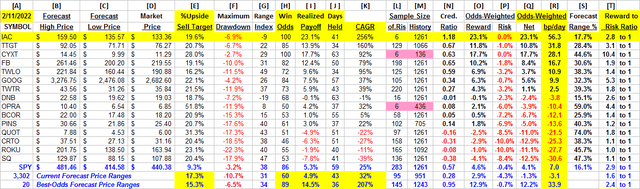

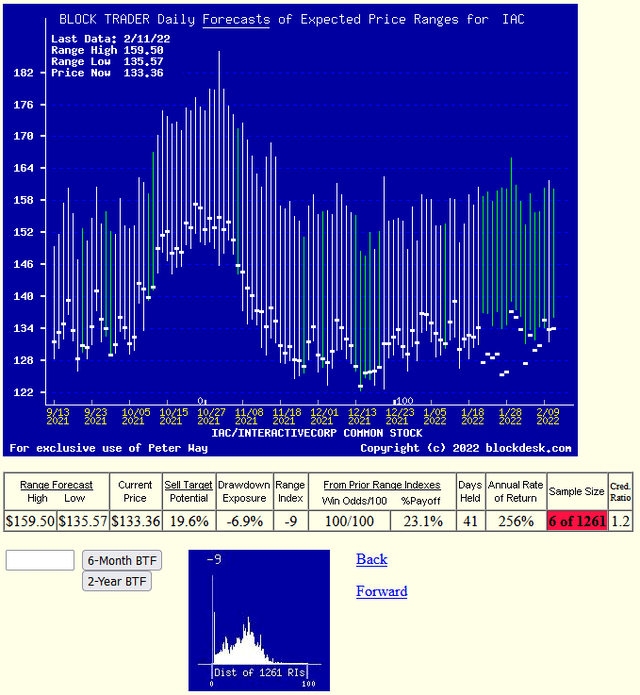

Figure 1 uses those forecasts in making comparisons of price Risk vs. Reward tradeoffs between alternative investments.

Risk-Reward Comparisons Among Candidates

Figure 1

blockdesk.com (used with permission)

Each stock is positioned in this map by its intersection of upside price change forecast on the green horizontal scale and experienced price drawdown exposures (on the red vertical scale) typical after prior forecasts like today’s. Any issue located above the dotted diagonal has more potential risk than return at its present price. Issues located below the horizontal price-growth-rate scale are the product of a lack of adequate data to measure price decline risk exposures. They should be ignored.

A market-reference norm by SPY is at location [3]. Notably, only one of the internet content provider stocks has less downside risk than SPY, but most of them have higher reward prospects. The most opportune on a reward-to-risk basis is [14], Cyxtera Technologies (CYXT). Our principal interest is in IAC, at location [22].

Since price-change risk is a dynamic, not a constant, in time these exposure relationships will change. It is these changes that provide fresh opportunities for active investment capital gains on a shorter-term recurring basis. Besides just the downside price exposure, there may be other investment attributes investors will want to consider. Figure 2 provides some of these.

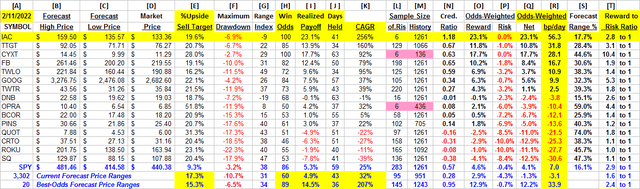

Detailed Competitive Change Data

Figure 2

blockdesk.com (used with permission)

The price-range forecast limits of columns [B] and [C] get defined by MM hedging actions to protect firm capital required to be put at risk of price changes from volume trade orders placed by big-$ “institutional” clients.

[E] measures potential upside risks for MM short positions created to fill such orders, and reward potentials for the buy-side positions so created. Prior forecasts like the present provide a history of relevant price drawdown risks for buyers. The most severe ones actually encountered are in [F], during holding periods in an effort to reach [E] gains. Those are where buyers are most likely to accept losses.

[H] tells what proportion of the [L] sample of prior like forecasts have earned gains by either having price reach its [B] target or be above its [D] entry cost at the end of a 3-month max-patience holding period limit. The pink [L]-[M] cells flag two stocks with smaller lengths of forecast histories then the 3-year 700+ market days of forecasts which we regard as essential for comparisons.

[I] gives the net gains-losses of those [L] experiences and [N] suggests how credible [E] may be compared to [I]. Further, Reward~Risk tradeoffs involve using the [H] odds for gains with the 100 – H loss odds as weights for N-conditioned [E] and for [F], for a combined return score [Q]. The typical position holding period [J] on [Q] provides a figure of merit [fom] ranking measure [R] useful in portfolio position preference. Figure 2 is row-ranked on R among candidate securities, with IAC in top rank.

For perspective, along with the candidate-specific stocks, these selection considerations are provided for the averages of over 3300 stocks for which MM price-range forecasts are available today. The 20 best-ranked (by fom) of those forecasts, and the forecast for S&P 500 Index ETF as an equity market proxy may also be noted.

IAC’s bp/day prospect of 56 bp/day when compounded over a 252 market-day year, adds up to the 256% gain in [K] if sustained for a year. But its next 3-month high price target of $159.50 at +19% above the forecast-current price of $133.36 leaves the remaining +96% to be compounded from other selected investments able to achieve gains at the same 56 bp/day rate in the remaining 211 market days of the year, if it takes the prior average of 41 days to earn this +19%.

All those ifs are what make it easier to keep score by simply adding up the realized bps and the days required to achieve them, then to divide one by the other to derive an average CAGR for your portfolio.

Among the 20 best-ranked of all 3,302 of today’s MM price-range forecasts, their high Win Odds (89 of 100) and short holding periods (36 days) boost their average CAGRs to 207%. Here IAC compares quite competitively at +256% in contrast to the MM-forecast population CAGR of 32% and that of SPY at +25%.

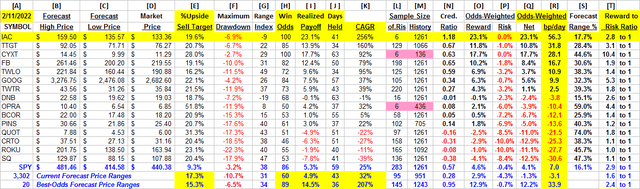

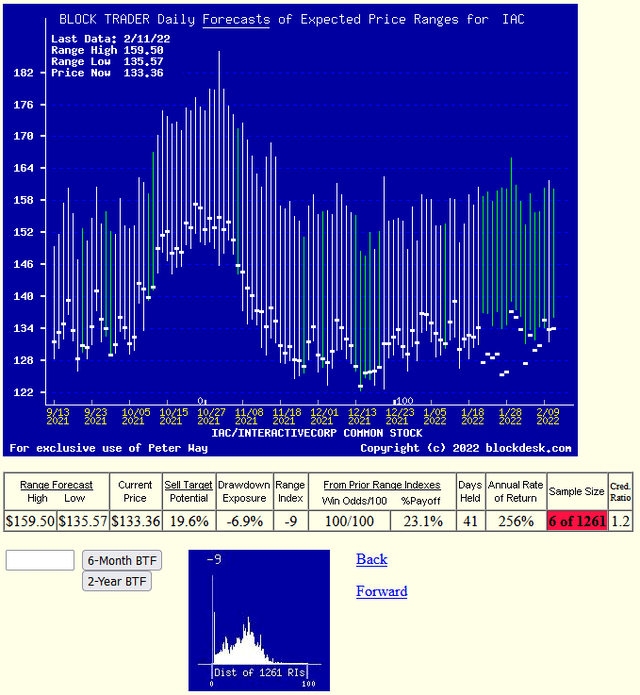

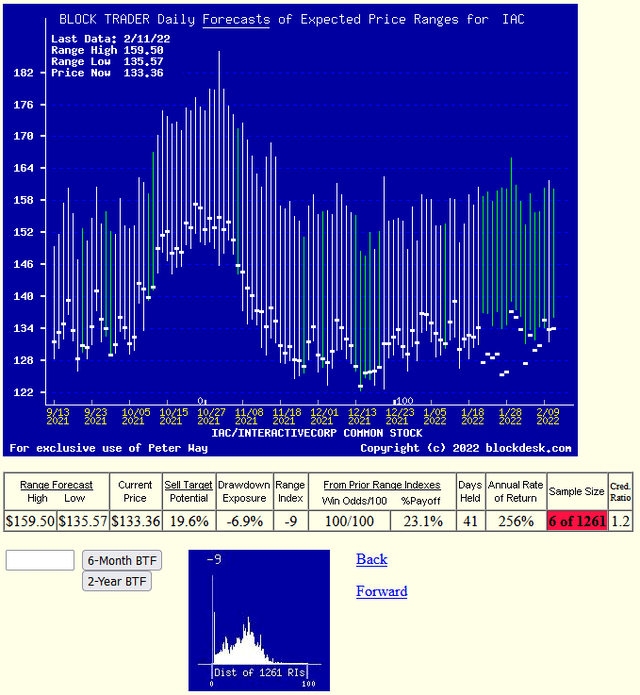

Recent Trends in IAC Price-Range Forecasts

Figure 3 shows the daily MM hedging-implied price-range forecasts of the past 6 months as vertical lines. Unlike “technical analysis charts” which study solely past prices, these are forward-looking expectations of prices yet to come in the next few months. They are the forecasts made daily during the past 6 months.

Each forecast is divided into upside and downside price change prospects by the heavy dot of the stock’s market close price on the day the forecast was made. These are records of direct expressions of what is reasonably being expected and where capital has been put at risk, not some hypothetical hopes of past price repeats.

Figure 3

blockdesk.com — used with permission

The small picture at the bottom of Figure 3 presents the past 5 years’ daily record of where the market quotes split each forecast into upside and downside proportions. The current Range Index of -9 indicates how infrequently IAC is priced this low, actually below the range considered reasonable by the MM pros.

Conclusion

The above comparison of IAC/InterActiveCorp with its best competitors indicates a buy in the stock at this time should provide capital gain satisfactions in the next few months.

Additional disclosure: Peter Way and generations of the Way Family are long-term providers of perspective information (earlier) helping professional and [now] individual investors discriminate between wealth-building opportunities in individual stocks and ETFs. We do not manage money for others outside of the family but do provide pro bono consulting for a limited number of not-for-profit organizations.

We firmly believe investors need to maintain skin in their game by actively initiating commitment choices of capital and time investments in their personal portfolios. So our information presents for their guidance what the arguably best-informed professional investors believe, revealed through their own self-protective hedging actions, is most likely to happen to the prices of specific issues in coming weeks and months. Evidences of how such prior forecasts have worked out are routinely provided at our SA blog.

Source link