Best Bad Credit Loans June 2023

Written by Lucky Wilson | KGTO Writer on June 9, 2023

When you find yourself in a difficult situation and need an immediate personal loan, bad credit may often imply that you have little to no viable options. But that does not always have to be the case.

We have carefully selected a collection of the best payday companies in the US that can provide you with the necessary assistance to obtain a bad credit personal loan with guaranteed approval up to $5,000.

Regardless of your employment status, credit history, income, or even credit score, the personal loans offered by these companies have been specifically tailored to ensure that you can meet your unforeseen financial obligations.

Bad Credit Loan Guaranteed Approval $5,000 Lenders

From this list of the best brokers for bad credit personal loans, you can easily secure a guaranteed $5000 loan.Typically, the approval process is fast, allowing you to obtain your loan almost instantly.

For a detailed comparison of the aforementioned companies, continue reading below.

1. Honest Loans: Best bad credit personal loan lender

Are you experiencing a financial crisis and all you need is a personal loan with guaranteed approval of $5,000? Then Honest Loans is the best place to look. Honest Loans have lending amounts that span $100 to $50,000. They extend these loans to all individuals regardless of their credit score and history.

Honest Loans should be a top consideration for bad credit personal loans guaranteed approval of $5,000 for the following reasons:

- Fast access to cash due to their fast approvals.

- Same-day funding.

- Easy online application.

- Its loan amounts are accessible even to individuals with bad credit.

- Secure personal loan lending.

- Guaranteed approvals.

- A wide berth of personal loans to choose from.

Honest Loans is the best option for bad credit personal loans guaranteed approval of $5,000 as it has one the most friendly repayment rates in the US market.

2. Fast Loans Group: Most connected broker

Are you in need of a personal loan with guaranteed approval, but bad credit is holding you back? Fast Loans Group is a broker with strong connections to numerous lenders in the US who are willing to provide you with a bad credit personal loan, guaranteed approval, of up to $5,000.

Fast Loans offers a personal loan limit of $50,000, along with the advantage of fast approvals, ensuring that you can meet your expenses without delays.

Here are the reasons why Fast Loans Group is the go-to option for your bad credit personal loan with guaranteed approval:

- Flexible lending amounts.

- Excellent customer service team.

- Quick approvals for personal loans.

- Low-interest rates.

- Convenient online application.

With the above perks, it is no doubt that Fast Loans Group offers bad credit personal loans with guaranteed approval.

3. Fast Money Source: Best for Fast Loans

If you are in urgent need of a personal loan with guaranteed approval but bad credit is getting in the way, the Fast Money Source is where you should look. Fast Money Source is a broker company that emphasizes the value of privacy. With the best encryption technology in the market, Fast Money Source can protect your information.

Fast Money Source has guaranteed approvals for loan amounts of up to $5,000 despite its extensive lending range that taps out at $50,000. Below are the reasons why Fast Money Source ought to be your topmost priority when in need of a bad credit personal loan with guaranteed approval:

- Safety and privacy are ensured.

- Versatile personal loan terms and options.

- Easy to apply.

- Fast decisions on approval of personal loans.

- Borrower-friendly interest rates.

For secure borrowing, Fast Money Source is the best broker company for you to get your bad credit personal loan with guaranteed approval of $5,000.

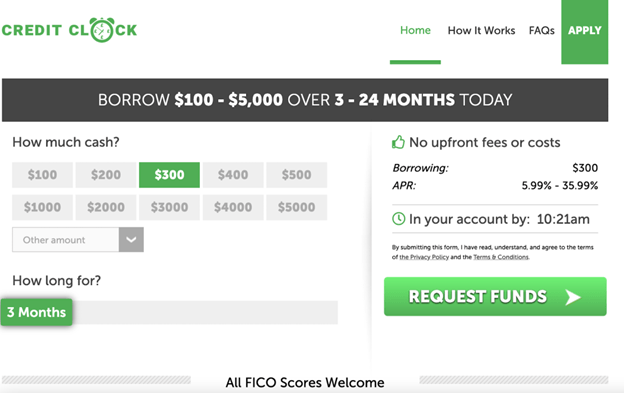

4. Credit Clock: Guaranteed personal loan approvals

Credit Clock is another leading lender in the US where you can effortlessly apply for a bad credit personal loan, guaranteed approval of $5,000. With Credit Clock’s guaranteed approval, you can be confident that you will have the means to meet your expenses, including unforeseen ones.

With a maximum lending amount of $5,000, Credit Clock is indeed a reliable broker. Here are additional reasons why Credit Clock stands out as the best option for bad credit personal loans:

- Instant personal loan approvals.

- Fast disbursement of funds.

- Friendly interest rates.

- The credit score is not considered.

- Flexible loan amounts.

Credit Clock has an understanding of what it feels like to lack cash at hand and as a result, implement the hastening of all processes to make you meet your obligations.

5. Big Bucks Loans: No credit checks personal loans

Big Bucks Loan is a personal loan broker in the US that provides guaranteed approvals for bad credit personal loans. It offers a maximum lending amount of $5,000, and this guarantee extends to individuals with bad credit.

Big Bucks ensures swift processes, ensuring that you receive your approved amount deposited into your account within 15 minutes.

Additional benefits of choosing Big Bucks as your go-to lender for a bad credit personal loan, guaranteed approval $5000.

- No consideration of FICO scores.

- Instant funds transfer.

- No extra fees or charges.

- High personal loan approval rates.

- Convenient online application.

- No credit prints left on your credit file.

With their high approval rates, Big Bucks Loans are a good choice for instant bad credit personal loans with guaranteed approval.

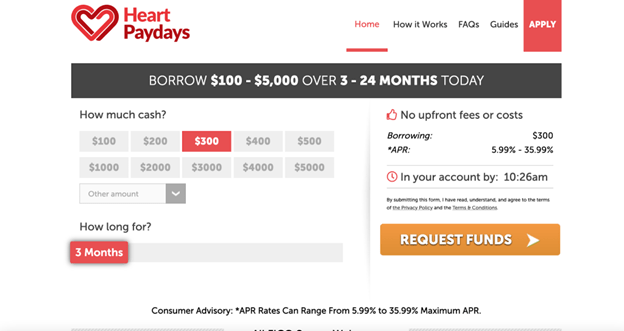

6. Heart Paydays: Low-interest rate bad credit personal loans

If you are an individual with bad credit and are seeking a lender who doesn’t take credit scores into account when providing personal loans, Heart Paydays is the ideal place to find such a lender. Heart Paydays offers bad credit personal loans, guaranteed approval of up to $5,000.

Heart Paydays takes pride in offering one of the lowest interest rates in the market. Consequently, you can enjoy cheap and affordable bad credit personal loans with guaranteed approvals to assist you in managing unexpected expenses and emergencies.

Below are the reasons why Heart Paydays stands out as a premium choice for personal loans:

- Low APR.

- Flexible repayment options.

- Instant personal loan approval.

- Low fees.

- A wide selection of loans to choose from.

Heart Paydays is the best place to your bad credit personal loan with guaranteed approval without any delays whatsoever.

7. Low Credit Finance: Convenient personal loan application

Are you looking for a lender who offers an easy personal loan application process? Low Credit Finance is where you should be looking. Low Credit Finance guarantees the approvals of personal loans even to borrowers with bad credit or no credit history. They offer loan amounts of up to $5,000 to make sure that you are not inconvenienced.

Coupled with their low interest rates, are affordable charges that make their loans affordable to acquire. Here are reasons why Low Credit Finance is where you should get your bad credit personal loan with guaranteed approval:

- Convenient online application.

- Well-connected to qualified lenders.

- Easy and convenient online application.

- Low fees.

- No hidden costs.

Low Credit Finance is the US broker to go to when in dire need of a bad credit personal loan with a guaranteed approval of $5,000 regardless of your credit score.

What Is a Bad Credit Personal Loan?

A bad credit personal loan refers to a type of loan that is specifically designed for individuals who have poor credit histories or low credit scores. It is intended to provide financial assistance to those who have been rejected by traditional lenders due to the inability to meet the creditworthiness criteria of such institutions.

The main purpose of a bad credit personal loan is to provide the bad credit borrowers with an opportunity to access funds for various personal needs, such as debt consolidation, emergency expenses, or other financial obligations, even if they have a history of credit challenges.

It is usually easy for any individual to be granted a bad credit personal loan as the application process is usually straightforward and does not involve a lot of tedious checks and processes that may delay the approval. Regardless of the quick solution these loans offer, it’s important to carefully consider the terms, fees, and repayment conditions of the loan before signing up for one.

How Do Bad Credit Personal Loans Work?

Bad credit personal loans operate similarly to other loan services offered by traditional financial institutions. They require the submission of an application, followed by a waiting period for approval. If all requirements are met and the criteria are satisfied, the funds are then transferred to the borrower’s designated bank account.

However, in contrast to conventional loans, the application process for bad credit personal loans is comparatively simpler and involves minimal paperwork. The entire process, including application, approval, and fund allocation, is conducted online. Automated systems are in place to streamline the procedure and verify eligibility and approval criteria. This allows for convenient access to funds without the need to visit physical offices or wait in queues.

Once all necessary approvals are obtained, you will receive comprehensive information regarding the terms and conditions of the agreement. Based on your assessment of the provided terms, you are then faced with the final step of either accepting or declining the loan based on its suitability.

Qualification Criteria For A Bad Credit Loan

Similar to loans from traditional financial institutions, bad credit personal loans also have specific eligibility criteria that must be met before approval. Below are the criteria you need to fulfill in order to be approved:

- A U.S. citizenship or permanent residency.

- Minimum age of 18 years old.

- A verifiable source of income.

- An active bank account.

- A valid phone number or email address.

These criteria are easy to meet and as a result, a good number of the applicants get approved for bad credit personal loans.

Credit Scores Relation with Bad Credit Personal Loans

The credit score is an important aspect that serves as an assessment of an individual’s creditworthiness, after considering various factors. On top of that it has a huge implication on whether you receive a loan from a financial institution or not. However, when it comes to bad credit personal loans, credit scores hold little to no significance and do not influence the borrowing process in any way.

Nevertheless, many lenders conduct soft credit checks as a standard procedure before approving the loan. These credit checks are conducted are soft, to ensure that accessing the requested personal loans is more convenient for you.

It is crucial to understand that while bad credit personal loans do not directly consider your credit score, they have a direct impact on it. They do so in this sense, making early repayments on your loan improves your credit rating. Moreover, for borrowers without a credit history, bad credit personal loans provide a favorable starting point for establishing their credit rating.

Bad Credit Personal Loans Vs Conventional Loans

Bad credit personal loans differ from conventional loans in the following aspects:

- Loan purpose – While bad credit personal loans are typically designed to cover short-term, immediate financial needs and unexpected expenses, conventional loans serve long-term purposes, such as purchasing a house, financing education, or consolidating debt.

- Loan amount and repayment period – Bad credit personal loans usually offer smaller loan amounts, with shorter repayment periods. Conventional loans, on the other hand, provide larger loan amounts and longer repayment periods, often spanning several years.

- Credit check and eligibility – While bad credit personal loans generally have more lenient eligibility requirements and may not require a credit check or collateral, conventional loans involve more stringent eligibility criteria, including credit checks and collateral in most cases.

- Interest rates and fees – Bad credit personal loans have higher interest rates and fees compared to conventional loans. The higher rates and fees are resultant of the increased risk associated with lending to individuals with bad credit.

- Application and approval process – Bad credit personal loans have a simplified and expedited application process, often completed online whereas conventional loans have more extensive documentation and a longer approval process.

- Application and disbursement speed – Bad credit personal loans are known for their quick processing times, with funds often deposited in the borrower’s account within a few hours or in some cases minutes after approval. In contrast, conventional loans take longer as the process involves a longer application review period, which can take several days or even weeks. If you need a fast loan click Here

Regulation in the US

In recent years, bad credit personal loans have generated significant discussions. These discussions have prompted the implementation of regulations aimed at addressing concerns surrounding the lending practices associated with such loans. These regulations encompass various measures enacted at both the state and federal levels.

For instance, one regulatory approach involves imposing limits on the maximum loan amounts that borrowers can obtain within a particular state. In more stringent cases, certain states have gone a step further by completely prohibiting bad credit personal loans to protect consumers from what is perceived as predatory lending practices.

As a result, it is crucial for individuals seeking bad credit personal loans to carefully review the eligibility requirements and regulations specific to their state before proceeding with an application. By doing so, they can ensure compliance with local laws and make informed decisions regarding their financial needs.

Pros and cons

Pros

- Accessibility – Bad credit personal loans are easily accessible to individuals with poor credit or limited credit history. This makes them a good option if you are in urgent need of cash.

- Flexibility – Bad credit personal loans offer flexibility in terms of the loan amount, terms and repayment period. This allows the borrowers room to negotiate and settle for terms that will suit them.

- Quick approval – Bad credit personal loans often have fast approval processes which allow borrowers to receive funds relatively quickly ensuring that funds are available when they are needed the most.

- Diverse lender options – As the market for bad credit personal loans is diverse with various lenders, borrowers can make comparisons from the available options and select the lender that best fits their needs in terms of interest rates, repayment terms, and loan amounts.

- No collateral required – As bad credit personal loans are unsecured, borrowers do not need to provide collateral, such as property or assets, to secure the loan. This reduces the risk of losing valuable possessions in case of default.

Cons

- Higher interest rates – Bad credit personal loans often come with higher interest rates compared to loans offered to borrowers with good credit. Lenders consider bad credit borrowers to be higher risk, resulting in increased interest rates to compensate for that risk. The interest rates are usually between 300-400% APR.

- Potential for predatory lending – Some lenders are in the bad credit personal loan market to engage in predatory lending practices such as taking advantage of vulnerable borrowers and exploiting them.

- Potential for debt cycle – If bad credit personal loans are not managed responsibly they can contribute to a cycle of debt. A situation whereby you are tempted to take out additional loans to cover existing obligations, leading to a continuous cycle of borrowing and accumulating debt.

Conclusion of Bad Credit Loans

In conclusion, bad credit personal loans can be a valuable financial tool for individuals facing challenging credit situations when used for the right purposes. While they come with certain advantages, it’s crucial to also consider the associated drawbacks to help you make informed decisions. Ultimately, by exploring alternative options and understanding the pros and cons, you can navigate the world of bad credit personal loans more confidently and make choices aligned with your financial goals and circumstances.

Frequently Asked Questions

Are bad credit personal loans safe?

Bad credit personal loans can be safe if you borrow from reputable and trustworthy lenders. It’s crucial to research and verify the lender’s credentials, read the loan terms carefully, and ensure there are no hidden fees or predatory practices. You should consider looking for lenders with positive customer reviews and ratings. See Here our full review on Bad Credit Loans

Can I repay a bad credit personal loan early?

It depends on the terms and conditions set by the lender. Some lenders allow early repayment without any penalties, while others may charge prepayment fees. It’s important to review the loan agreement or contact the lender directly to understand their policies regarding early repayment.

Can I get a bad credit personal loan if I am self-employed?

Yes, being self-employed does not necessarily disqualify you from getting a bad credit personal loan. However, you may need to provide additional documentation to verify your income, such as tax returns or bank statements.

What happens if I default on a bad credit personal loan?

Defaulting on a bad credit personal loan can have serious consequences, including damage to your credit score and additional fees or penalties from the lender. The lender may also pursue collection activities, including legal action, to recover the outstanding amount.

Source link